Introduction

In the fast-paced world of cryptocurrency trading, mastering technical analysis is crucial for making informed decisions. Traders often rely on various chart patterns to identify trends and potential price movements. Two patterns that stand out in the realm of crypto chart analysis are rectangles and flags. In this comprehensive exploration, we will delve into the intricacies of these patterns, uncovering their significance and providing insights into how traders can leverage them for more effective decision-making.

Understanding Rectangles | Building the Foundation

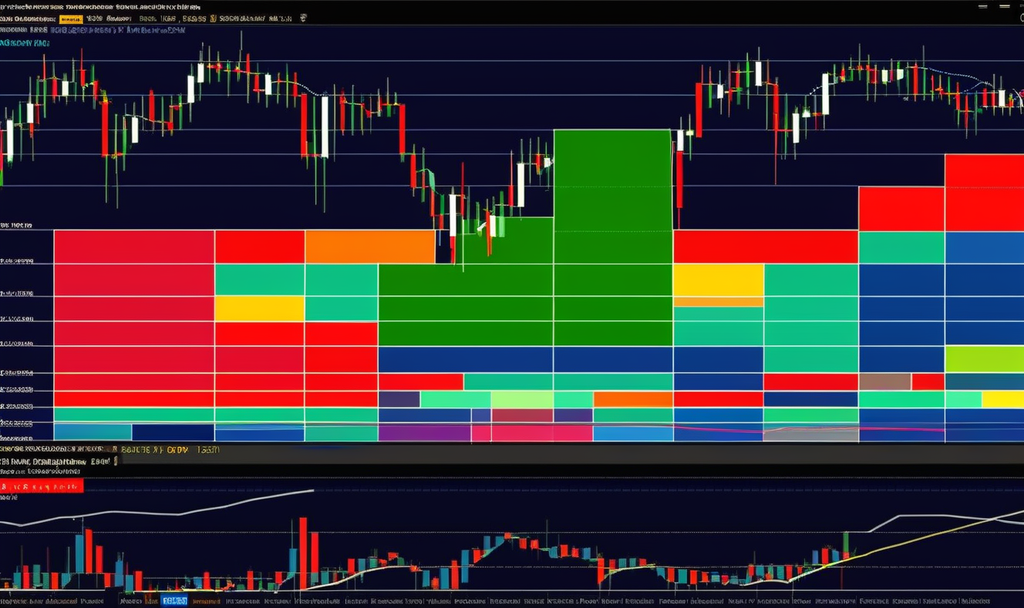

Rectangles, as the name suggests, are geometric patterns that form on price charts, representing a period of consolidation in the market. These patterns are characterized by parallel horizontal lines, indicating a balance between buyers and sellers. Traders often identify rectangles as a potential signal for an impending breakout or breakdown, making them a valuable tool in predicting price movements.

Rectangles are typically categorized into two types: continuation and reversal. Continuation rectangles occur within an existing trend, signifying a temporary pause before the prevailing trend resumes. On the other hand, reversal rectangles suggest a potential change in trend direction, offering traders a heads-up for a possible trend reversal.

Spotting Rectangles in Crypto Charts

To effectively utilize rectangles in crypto chart analysis, it’s essential to recognize their formation and significance. Traders can identify rectangles by observing periods of horizontal price movement, with clear support and resistance levels. These levels create the parallel lines that define the rectangle pattern.

In continuation rectangles, the market consolidates before continuing its established trend. This pattern often indicates a brief period of indecision among market participants before the prevailing trend reasserts itself. Traders should closely monitor the breakout direction to align their strategies with the ongoing trend.

In reversal rectangles, the pattern signals a potential change in market sentiment. As prices move within the rectangle, traders anticipate a breakout that may lead to a reversal of the existing trend. Analyzing volume during the breakout can provide additional confirmation of the pattern’s validity.

Flags | Unfurling the Crypto Market Dynamics

Moving on to flags, these patterns are another essential aspect of crypto chart analysis. Flags are continuation patterns that resemble, well, flags on a flagpole. They typically occur after a strong price movement, representing a brief consolidation before the trend continues.

Bullish flags and bearish flags differ in their implications for the market. Bullish flags form after an upward price movement, signaling a temporary pause before the uptrend resumes. Conversely, bearish flags emerge after a downward price movement, indicating a brief consolidation before the downtrend continues.

Practical Application of Flags in Trading

Traders can leverage flags to make informed decisions about market entry and exit points. Identifying the flag pattern involves recognizing the flagpole, which represents the initial strong price movement, and the flag itself, which is characterized by parallel trendlines converging towards each other.

When trading bullish flags, investors often enter long positions as the price breaks above the upper trendline, anticipating a continuation of the upward trend. On the other hand, bearish flags may prompt traders to short positions as the price breaks below the lower trendline, expecting a continuation of the downtrend.

Combining Rectangles and Flags | A Dynamic Duo

While rectangles and flags serve distinct purposes in crypto chart analysis, combining these patterns can enhance the precision of trading strategies. Traders can look for rectangles within the flag formations, providing additional insights into potential price movements.

For example, if a bullish flag forms after a strong upward price movement, identifying a continuation rectangle within the flag may indicate a brief consolidation before the uptrend resumes. This combination of patterns strengthens the signal for a potential long position, aligning with the prevailing market sentiment.

If you have any question about this article, please contact us …

You can easily create a free cryptocurrency wallet with binance …

Conclusion | Navigating the Crypto Seas with Confidence

In conclusion, exploring rectangles and flags in crypto chart analysis unveils a world of opportunities for traders. Understanding the dynamics of these patterns empowers investors to make well-informed decisions, enhancing their ability to navigate the volatile crypto seas with confidence.

By recognizing the nuances of rectangles and flags, traders can decipher market sentiment, identify potential trend reversals, and strategically time their entries and exits. Whether you’re a seasoned trader or a newcomer to the crypto space, incorporating these patterns into your technical analysis toolkit can significantly improve your chances of success in the dynamic and ever-evolving world of cryptocurrency trading.