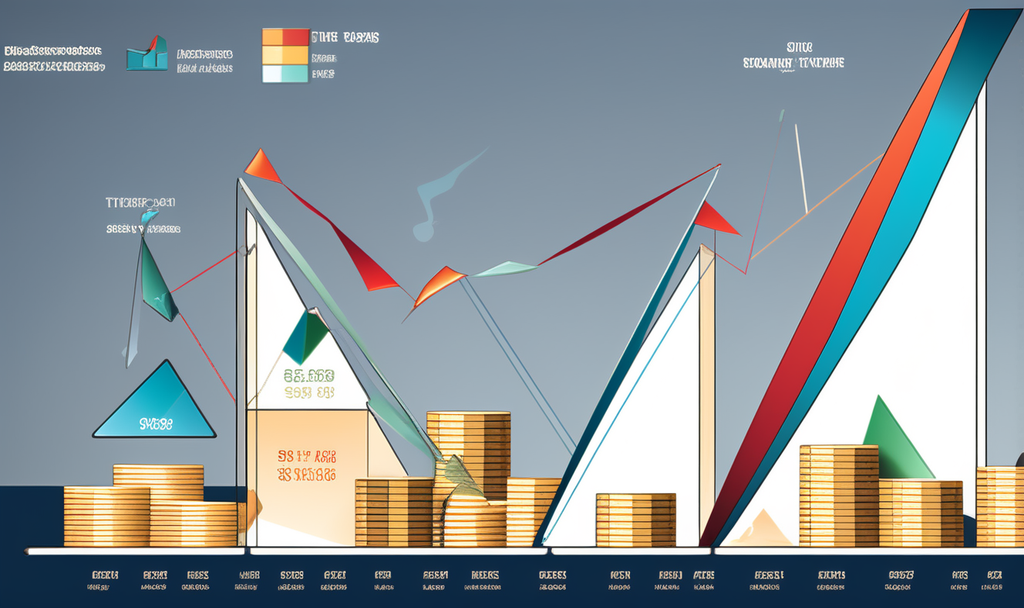

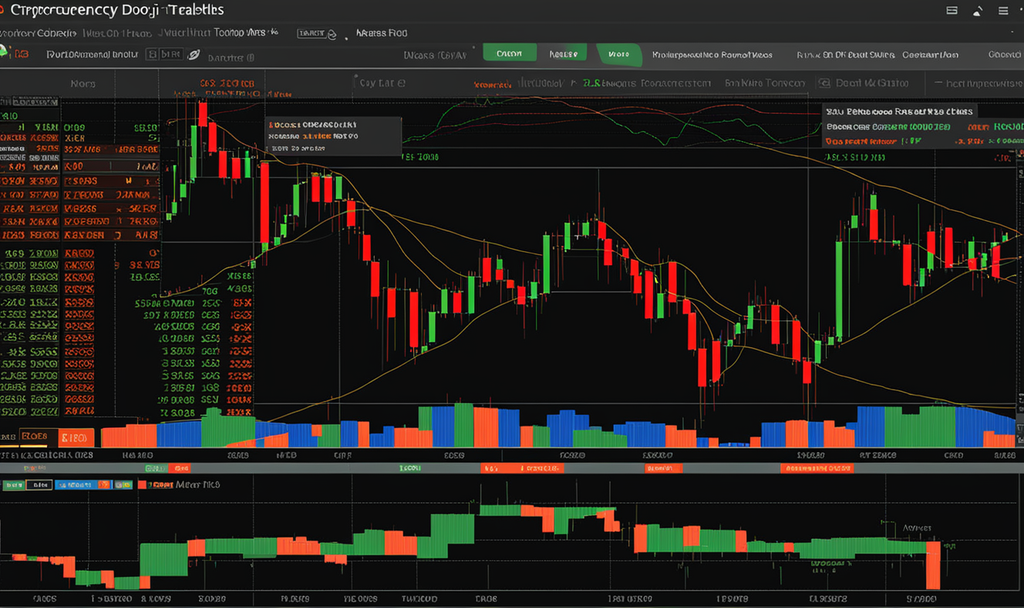

Exploring the Pennant and Wedge Patterns in Cryptocurrency Trading

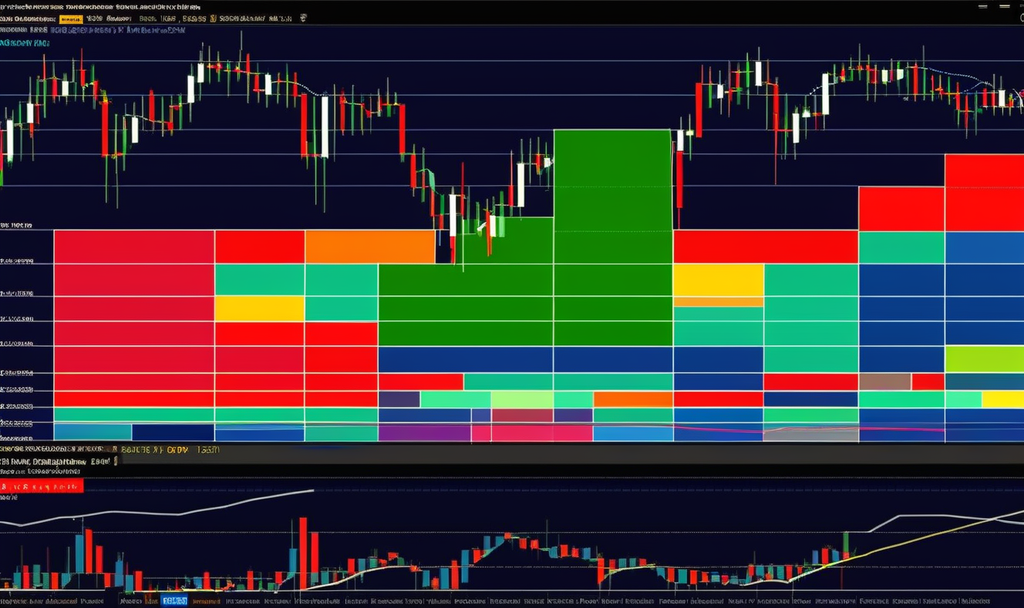

Introduction: In the ever-evolving realm of cryptocurrency trading, seasoned investors and beginners alike continually seek strategies to gain a competitive edge. Two distinctive chart patterns, the Pennant and Wedge, have emerged as valuable tools in technical analysis. These patterns, when properly understood and interpreted, can offer insights into potential market trends and aid in making […]

Exploring the Pennant and Wedge Patterns in Cryptocurrency Trading Read More »