Introduction:

In the dynamic realm of cryptocurrency trading, where market conditions can change in the blink of an eye, having a well-defined strategy is crucial for success. Traders often turn to backtesting as a powerful tool to evaluate and refine their trading strategies. In this blog post, we will delve into the significance of backtesting strategies using trading platforms in the crypto world.

Understanding Backtesting:

Backtesting involves simulating a trading strategy using historical data to assess its performance. By applying the strategy to past market conditions, traders can gain insights into its effectiveness and potential risks. This process allows traders to fine-tune their strategies before implementing them in real-time markets.

Choosing the Right Trading Platform:

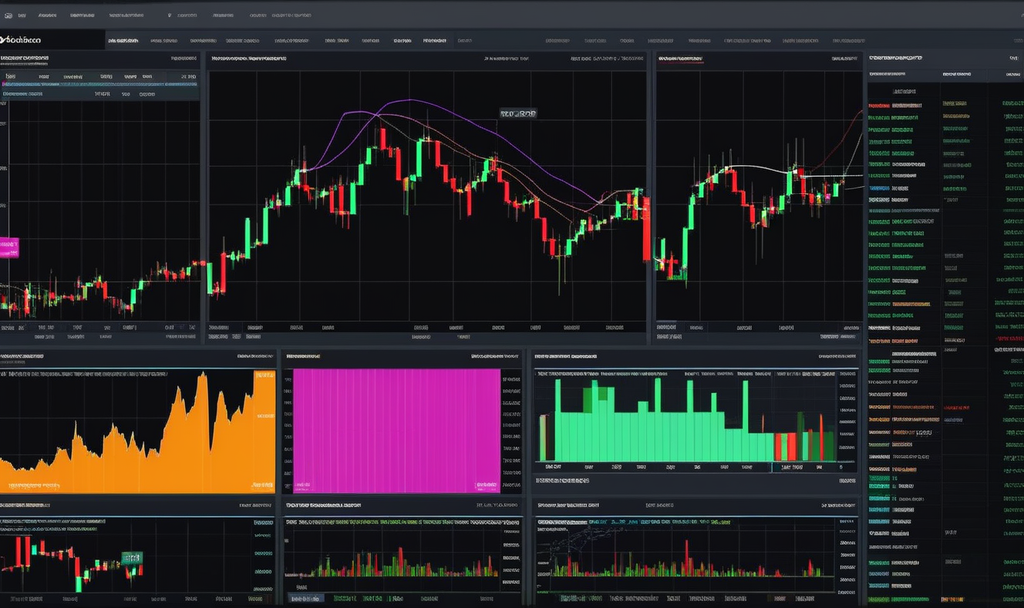

Selecting a reliable trading platform is the first step towards successful backtesting. Ensure the platform provides access to historical data, technical indicators, and allows you to execute simulated trades. Platforms like TradingView, MetaTrader, and Backtrader are popular choices among crypto traders for their robust backtesting capabilities.

Setting Up Backtesting Parameters:

Once you’ve chosen a suitable platform, it’s time to define the parameters for your backtest. Specify the time frame, trading pair, and other relevant settings based on your strategy. This step is crucial for obtaining accurate and meaningful results.

Analyzing Historical Data:

Effective backtesting relies on the quality of historical data. Ensure that the data used in the simulation is accurate and reflects the actual market conditions during the specified time frame. Cryptocurrency markets are known for their volatility, so having precise data is paramount for reliable results.

Implementing the Strategy:

With the parameters in place, it’s time to implement your trading strategy. This involves executing simulated trades based on the historical data, allowing you to observe how the strategy would have performed in the past. Pay close attention to key indicators, entry and exit points, and overall profitability.

Evaluating Performance Metrics:

After the backtest is complete, analyze the performance metrics to gauge the effectiveness of your strategy. Key metrics include profit and loss, win-loss ratio, maximum drawdown, and risk-adjusted returns. These metrics provide valuable insights into the strengths and weaknesses of your trading strategy.

Refining the Strategy:

Backtesting is not a one-time process; it’s an iterative cycle. Use the insights gained from the initial backtest to refine and optimize your trading strategy. Adjust parameters, incorporate new indicators, or explore different time frames to enhance the strategy’s overall performance.

The Importance of Realism in Backtesting:

While backtesting provides valuable insights, it’s essential to approach it with a degree of realism. Market conditions can change, and unforeseen events can impact the effectiveness of a strategy. Consider incorporating slippage, transaction costs, and other real-world factors into your backtesting to make it more accurate and reflective of actual trading conditions.

Avoiding Overfitting:

One common pitfall in backtesting is overfitting – tailoring a strategy too closely to historical data, making it less effective in real-time markets. Strike a balance between optimizing your strategy and ensuring it remains adaptable to evolving market conditions.

If you have any question about this article, please contact us …

You can easily create a free cryptocurrency wallet with binance …

Conclusion:

In the fast-paced world of cryptocurrency trading, backtesting strategies using reliable platforms is a powerful tool for traders seeking consistent success. By carefully selecting platforms, defining parameters, and analyzing performance metrics, traders can refine and optimize their strategies for real-world implementation. Remember, backtesting is an ongoing process that requires adaptability and a realistic approach to stay ahead in the ever-changing crypto markets.