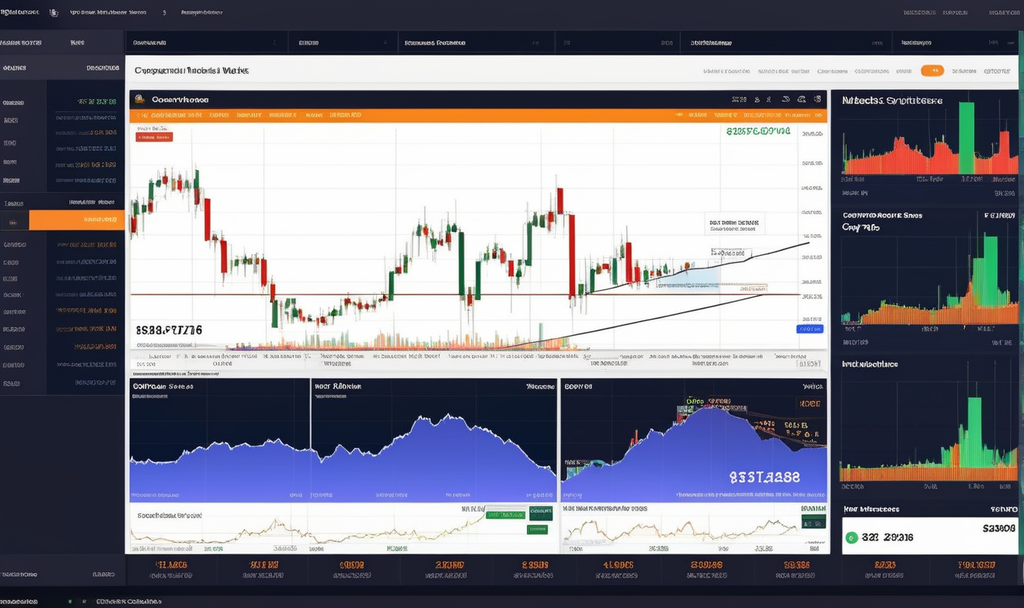

Customizing Technical Analysis Based on Timeframe and Market Conditions

In the dynamic world of financial markets, where conditions can change rapidly, adopting a flexible approach to technical analysis is crucial for successful trading. Traders often employ various tools and indicators to make informed decisions, but one size does not fit all. Customizing technical analysis based on timeframes and market conditions is the key to […]

Customizing Technical Analysis Based on Timeframe and Market Conditions Read More »